All Categories

Featured

Table of Contents

The strategy has its very own benefits, yet it additionally has issues with high fees, intricacy, and extra, leading to it being considered as a fraud by some. Boundless banking is not the finest plan if you need just the investment component. The infinite financial idea revolves around making use of whole life insurance coverage plans as an economic device.

A PUAR allows you to "overfund" your insurance plan right up to line of it becoming a Customized Endowment Contract (MEC). When you use a PUAR, you rapidly increase your cash money value (and your death benefit), thus enhancing the power of your "financial institution". Further, the more cash value you have, the higher your rate of interest and dividend payments from your insurance provider will certainly be.

With the increase of TikTok as an information-sharing platform, economic guidance and strategies have actually located a novel way of spreading. One such strategy that has actually been making the rounds is the limitless banking concept, or IBC for short, gathering endorsements from celebrities like rapper Waka Flocka Flame - Infinite Banking account setup. Nevertheless, while the method is presently popular, its origins map back to the 1980s when economist Nelson Nash presented it to the globe.

Who can help me set up Life Insurance Loans?

Within these policies, the cash value grows based upon a price set by the insurance firm. Once a significant cash money value accumulates, insurance policy holders can get a money value loan. These financings differ from conventional ones, with life insurance coverage functioning as security, meaning one might shed their coverage if loaning excessively without sufficient cash value to sustain the insurance policy costs.

And while the allure of these plans is noticeable, there are natural restrictions and dangers, requiring diligent money value surveillance. The strategy's legitimacy isn't black and white. For high-net-worth people or organization owners, specifically those utilizing approaches like company-owned life insurance coverage (COLI), the benefits of tax obligation breaks and compound growth can be appealing.

The appeal of boundless banking doesn't negate its difficulties: Expense: The foundational requirement, an irreversible life insurance policy policy, is more expensive than its term equivalents. Eligibility: Not everybody gets whole life insurance because of strenuous underwriting procedures that can exclude those with specific wellness or way of life conditions. Complexity and danger: The detailed nature of IBC, combined with its dangers, may hinder lots of, specifically when less complex and less risky choices are offered.

What makes Wealth Building With Infinite Banking different from other wealth strategies?

Allocating around 10% of your monthly revenue to the plan is just not possible for most people. Component of what you read below is just a reiteration of what has already been stated over.

So before you get on your own into a scenario you're not planned for, understand the complying with first: Although the idea is generally offered as such, you're not really taking a funding from on your own. If that were the instance, you would not need to repay it. Instead, you're obtaining from the insurance policy company and need to repay it with rate of interest.

Some social media posts recommend utilizing cash worth from whole life insurance to pay down charge card debt. The concept is that when you repay the financing with passion, the amount will be sent out back to your investments. That's not exactly how it functions. When you repay the finance, a section of that passion goes to the insurance coverage company.

What is the long-term impact of Privatized Banking System on my financial plan?

For the very first a number of years, you'll be paying off the payment. This makes it incredibly tough for your policy to accumulate worth throughout this time. Unless you can afford to pay a couple of to numerous hundred dollars for the next years or more, IBC won't work for you.

Not everybody must depend solely on themselves for economic safety. Cash flow banking. If you require life insurance policy, right here are some beneficial suggestions to consider: Take into consideration term life insurance policy. These policies give protection throughout years with considerable financial commitments, like home mortgages, pupil loans, or when taking care of little ones. Ensure to shop around for the best price.

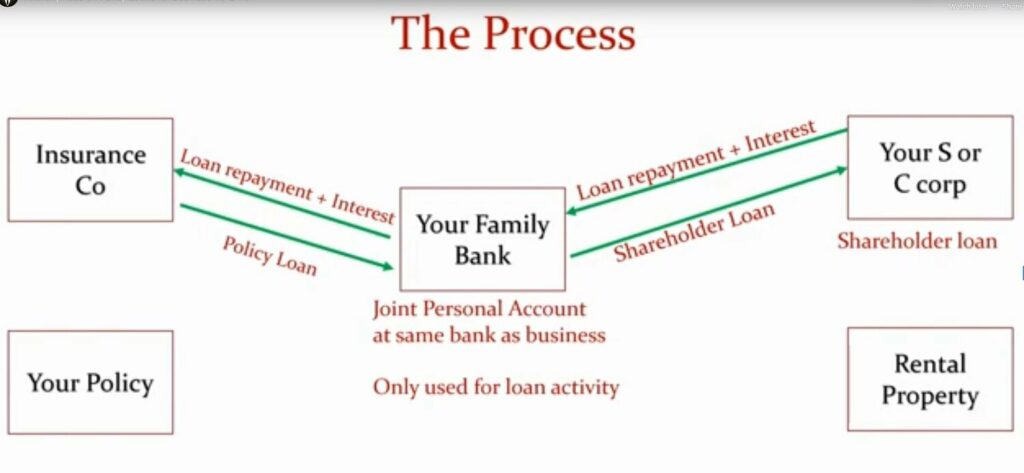

Through Infinite Banking, business owners eliminate reliance on banks. why infinite banking is growing in popularity.

This strategy allows businesses to handle cash flow issues without depleting savings.

Business finance specialists can optimize policies for maximum growth. Speak with an Infinite Banking professional today to unlock financial security.

What is the minimum commitment for Infinite Banking Account Setup?

Think of never ever needing to worry concerning bank loans or high interest prices once again. Suppose you could borrow cash on your terms and build wide range simultaneously? That's the power of unlimited financial life insurance policy. By leveraging the cash worth of entire life insurance policy IUL policies, you can expand your wide range and obtain money without relying upon traditional financial institutions.

There's no set funding term, and you have the freedom to select the settlement schedule, which can be as leisurely as repaying the funding at the time of death. This adaptability includes the maintenance of the financings, where you can choose interest-only settlements, maintaining the car loan balance flat and manageable.

How secure is my money with Tax-free Income With Infinite Banking?

Holding money in an IUL taken care of account being credited rate of interest can often be much better than holding the cash on deposit at a bank.: You have actually always dreamed of opening your own bakeshop. You can obtain from your IUL policy to cover the preliminary expenses of renting out a room, purchasing equipment, and hiring team.

Personal loans can be gotten from typical banks and credit score unions. Right here are some crucial factors to take into consideration. Charge card can supply a flexible means to obtain cash for really short-term periods. Borrowing cash on a debt card is generally really costly with yearly percent prices of rate of interest (APR) typically getting to 20% to 30% or more a year.

Table of Contents

Latest Posts

Whole Life Insurance Banking

Life Insurance Bank

Infinite Banking Course

More

Latest Posts

Whole Life Insurance Banking

Life Insurance Bank

Infinite Banking Course